Nvidia's Q3 Surge: Defying AI Bubble Fears with Record-Breaking Revenue

Nvidia, the chip giant, has surpassed Wall Street’s expectations for revenue and future sales in a remarkable quarterly earnings report, easing investor anxieties regarding the heavy spending in the artificial intelligence (AI) sector that has caused market volatility. For the three months ending in October, Nvidia reported an astonishing 62% increase in revenue, totaling $57 billion. This surge was largely fueled by skyrocketing demand for chips used in AI data centers, with sales from that division alone rising 66% to over $51 billion.

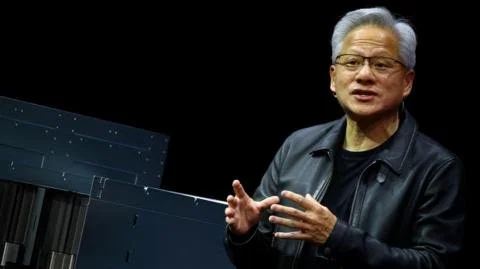

The optimistic outlook for fourth-quarter sales, projected between $65 billion, exceeded analyst forecasts, prompting a 4% jump in Nvidia’s share price during after-hours trading. Jensen Huang, Nvidia’s CEO, highlighted the overwhelming demand for their AI Blackwell systems and noted that their cloud GPUs are sold out. He argued against the notion of an AI bubble, claiming, “From our vantage point, we see something very different…We excel at every phase of AI.”

The release of this report captured significant attention as fears around the overvaluation of AI stocks loomed in the market, which had also seen the S&P 500 index drop for four consecutive days before Nvidia’s results were released. Analysts expressed confidence that Nvidia would outperform expectations, with Adam Turnquist of LPL Financial speculating on the scale of their success.

Despite the positive figures, Nvidia’s CFO Colette Kress lamented regulatory restrictions affecting chip exports to China, while implying the possibility of accepting additional orders beyond the previously announced $500 billion in AI chip orders expected through the next year.

Moreover, Huang’s announcement of a substantial data center complex in Saudi Arabia, which will utilize Nvidia chips and serve Elon Musk’s xAI as the first customer, further emphasized the demand for Nvidia’s solutions. A reported new agreement allows the sale of 70,000 advanced AI chips to state-backed companies in the Middle East, reversing previous restrictions and highlighting geopolitical influences on AI development.

Amid this, industry leaders have continued escalating their investments in AI. Comments from Sundar Pichai of Alphabet raised concerns about the current investment climate, with some likening it to the dotcom bubble of the late ‘90s, suggesting that while firms like Nvidia are thriving, many others in the tech ecosystem are not yet profitable. As Nvidia remains central to significant partnerships across the AI landscape, including a notable $100 billion investment in OpenAI, the company stands at the forefront of a possibly transformative era in technology.