Nvidia's Revenue Surge & AI Forecast: A Goldmine or the Next Bubble?

In a staggering display of market strength, Nvidia, the world’s leading chip maker, has blown past Wall Street’s expectations in its latest earnings report. The company reported a 62% increase in quarterly revenue, reaching $57 billion, largely propelled by a 66% jump in sales from its AI data centre segment which alone accounted for over $51 billion in revenue. This exceptional performance has sent shares soaring approximately 4% in after-hours trading, reaffirming Nvidia’s status as a crucial player in the booming AI sector.

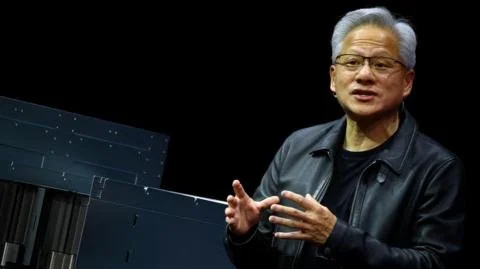

Nvidia’s CEO, Jensen Huang, emphasized the unprecedented demand for their AI Blackwell systems, referring to sales as being “off the charts.” Despite fears in the market regarding an AI bubble, Huang expressed confidence in the pervasive demand for their products across all areas of AI, asserting that ”we excel at every phase of AI”. This confidence comes in the face of recent volatility in the broader market, where concerns about overvaluation in AI stocks had led to a nearly 3% drop in the S&P 500 index earlier in the month.

As analysts noted, the anticipation surrounding Nvidia’s results was substantially high, with many believing the real question was not if they would exceed expectations, but by how much. Industry insiders like Adam Turnquist and Matt Britzman highlighted the distinctive position Nvidia holds, saying, “Nvidia is going about its business in style, contrasting with concerns about valuations in the AI sector.”

Looking forward, Nvidia’s CFO Colette Kress hinted at an impending increase in orders, predicting the company was on track to receive more than the previously mentioned $500 billion in AI chip orders. While expressing disappointment over U.S. regulatory barriers affecting exports to China, Kress reiterated Nvidia’s commitment to maintaining dialogue with international governments.

In addition to its robust earnings, Nvidia announced a major data center complex in Saudi Arabia, set to feature hundreds of thousands of Nvidia chips and cater to Elon Musk’s AI company, xAI. This project follows recent U.S. governmental approval to sell up to 70,000 advanced AI chips to state-backed firms in Saudi Arabia and the UAE, marking a shift in U.S. policy regarding technology exports.

Amid this backdrop of economic success, industry leaders are increasingly concerned about potential irrationality within the AI investment space, recalling historical precedents like the dotcom bubble. This skepticism underscores a need to discern between established companies like Nvidia that are generating substantial cash flow and the broader tech ecosystem, where many firms lack profitability. As the AI investment frenzy continues to unfold, Nvidia remains a key player not only in technology markets but also in the evolving landscape of AI innovation.